Cayman Islands, Panama and Seychelles added to the EU “blacklist”

18 February 2020 the European Commission has published an information about the regular update of the “blacklist” of non-cooperative jurisdictions for tax purposes. This time

18 February 2020 the European Commission has published an information about the regular update of the “blacklist” of non-cooperative jurisdictions for tax purposes. This time

In December 2019 the Municipality of Limassol has published an information of imposition of annual trade license fees on legal entities in this region of

On 19 December 2019 the information about the duty of all International Business Companies (IBC) in Belize to fill and submit the forms about intellectual

On 18 December 2019 the Registrar of Companies of Cyprus has announced that the date of entry into force of amendment of Companies Law Cap.

8 November 2019 the Council of the European Union has informed of its decision to exclude Belize from the “blacklist” of non-cooperative jurisdictions for tax

1 January 2019 British Virgin Islands (BVI) has adopted legislation on economic substance requirements applicable to companies incorporated in BVI. As this legislation was adopted

As it was informed in mass media and confirmed by representatives of Seychelles Revenue Commission (SRC) in late September 2019, France has made 66 requests

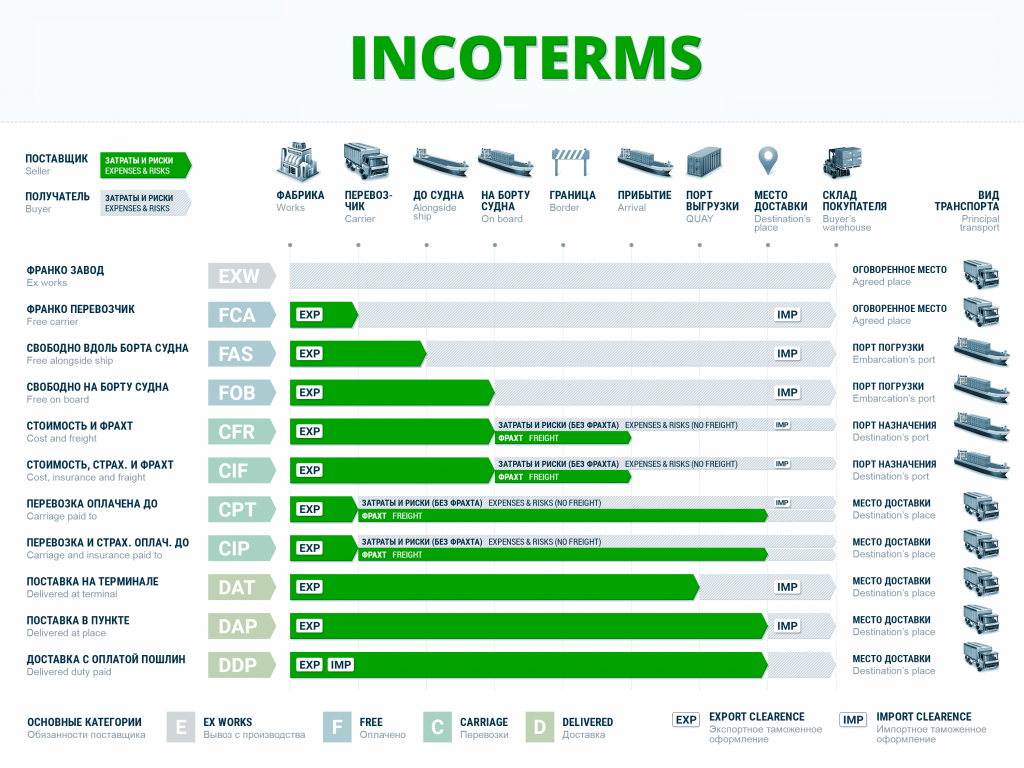

On 10 September 2019 the International Chamber of Commerce (ICC) has released Incoterms 2020 – the latest version of international commercial terms. The Incoterms rules

10 October 2019 the Council of European Union (EU) has made several changes in the list of non-cooperative jurisdictions for tax purposes once again. 2 jurisdictions

Due to establishment of territorial taxation of business activity in Seychelles in January 2019 the need for guidance to some legislative rulings, such as official